Lease accounting compliance solutions for everyone

Choose the solution that fits your project:

See how easy lease accounting can be.

Get compliant in hours so you can meet every deadline.

Webinars

Build your lease accounting skills

Free Resource

Lease accounting examples

We’ve built a set of lease accounting examples to help you get started.Under 6 leases?

All the software you need to get compliant for free

Virtual Lease Accounting

SEMINAR

Wednesday 17 May 2023

11am ET - 2:30pm ET | 3 CPE Credits

Widely used, highly rated

Great software for leases and ASC 842

“With EZLease we have the technical horsepower to account for and report [leases] correctly... EZLease [also] gives me the detailed entries, disclosures, and information I need to keep up with the latest accounting requirements. Very reasonable price and support has always been good.”

Ken D.

Construction industry

Software user for 2+ years

Great and user-friendly lease software

"Very happy that we chose to go with EZLease... have always provided great customer service and support... software is very straight forward and makes self-implementation run smoothly… support team response time is very quick and helpful. The price is also very reasonable."

Adriana S.

Staff Accountant

Excellent product

"We have an automotive company that engages in purchase leasebacks. Per the new accounting rules, there was quite a bit of work that needed to be done from an administrative perspective. This has saved us COUNTLESS hours of work on a monthly basis. We are very pleased with the software."

Joel G.

CEO (Automotive industry)

Software user for 6-12 months

Made ASC 842 compliance and reporting straightforward and easy to understand

"EZLease maintains all of the lease schedules and we can run custom journal entries out of the system for direct upload into our ERP system. There are no manual calculations and the upload templates allow for bulk importing of large sets of data."

Administrator

Utilities industry

Great platform

"Extremely user-friendly and web-based so we can access it from anywhere... able to condense so much of our lease data into one place [and] updated User Defined Fields to customize important information. The support staff has [also] been quick to respond to our questions."

Verified user

Health, wellness & fitness industry

5 star reviews

Standard

Overview of FASB lease accounting standard

In 2019, the latest FASB standard on lease accounting, ASC 842 (ASU 2018-11), went into effect for most public companies.

Guide

How to choose lease accounting software

Ask your software vendor these 10 questions to determine if they have what it takes to help you get and stay compliant.

Brochure

EZLease overview

The fastest, easiest way to comply with ASC 842, GASB 87, GASB 96, and IFRS 16. Guaranteed!

Standard

Optimize IFRS 16 compliance

In 2019, the latest IASB lease accounting standard, IFRS 16, began to go into effect for companies worldwide.

Standard

GASB 87 lease accounting standard

GASB 87 changed how most leases are reported by requiring them to be capitalized and recorded on the balance sheet.

Standard

GASB 96 SBITA accounting standard

Learn how to account for Subscription-Based Information Technology Arrangements (SBITAs) under GASB 96.

Overview of FASB lease accounting standard

In 2019, the latest FASB standard on lease accounting, ASC 842 (ASU 2018-11), went into effect for most public companies.

Confessions of a spreadsheet martyr

Spreadsheets may be inexpensive and easy to use, but they also overpromise and underdeliver. Find out...

ASC 842 lease accounting standard

For companies who want to achieve and maintain compliance with the lease accounting standard.

How to choose lease accounting software

Ask your software vendor these 10 questions to determine if they have what it takes to help you get and stay compliant.

Data sheet

The fastest, easiest way to comply with ASC 842, GASB 87, GASB 96, and IFRS 16. Guaranteed!

Optimize IFRS 16 compliance

In 2019, the latest IASB lease accounting standard, IFRS 16, began to go into effect for companies worldwide.

GASB 87 lease accounting standard

GASB 87 changed how most leases are reported by requiring them to be capitalized and recorded on the balance sheet.

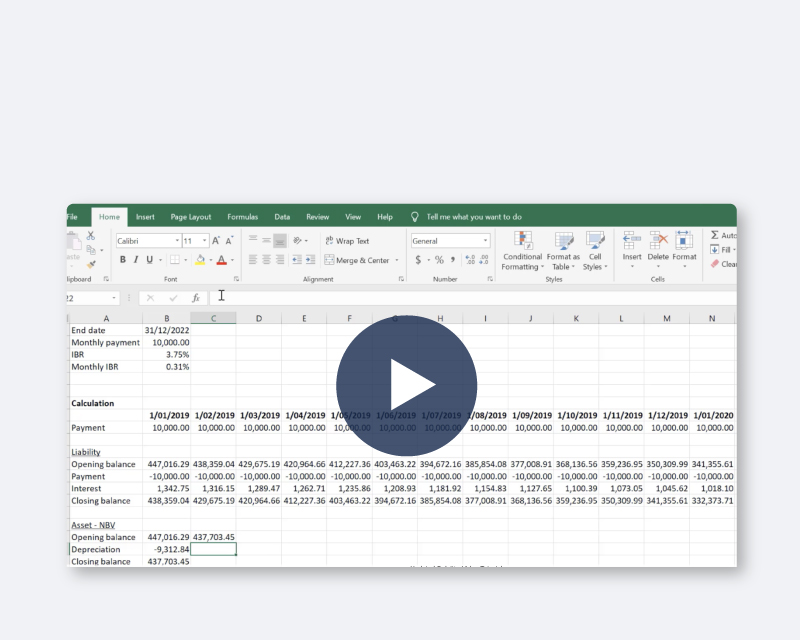

Start with easy lease accounting tutorials

We figure you probably don’t do lease accounting every day. To make your job easier, we’ve built a few simple examples that show how the lease accounting works under the current and previous standards. Each example has step-by-step instructions for the accounting for Capital/Finance leases and Operating leases to get you started.

At a glance, get the basics on Finance and Operating leases under ASC 842 / IFRS 16 and learn how the accounting used to be under FAS 13 / IAS 17 so it’s easy to see the difference. Then, follow just a few steps to enter the data into EZLease.

Read. Learn. Test for free.

Operating leases

Capital/Finance leases

Capital/Finance leases

We even have a 30-day money back guarantee – so the risk is on us.